Average Retirement Income for Canadian Teachers

The average retirement income for teachers who work and retire in Canada is $69,500 per year, after taxes. This income varies by province, and ranges from $65,000 to $72,000. Let's dig into where this number comes from...

Figuring out the average retirement income from any retired proffesion involves data-mining, making assumptions and doing calculations. Unfortunately, this data is not readily available from Statistics Canada or other sources.

Sources of Income

Retired teachers in Canada have several income sources, including a defined benefits pensions, CPP, OAS, RRSPs, and TFSAs. Here's how each income source was calculated:

Pension

The teachers defined benefits pension was determined as the average retirement pension for teachers in Canada. Sources such as suggest the average is $46,000 per year. This ranges by province and ranges between $30,000 to $60,000. We used $46k for this calculation.

Average Teacher's Pension

The teachers defined benefits pension was determined as the average retirement pension for teachers in Canada. Sources such as Pension Solutions Canada and Teachers Pension Plan BC suggest the average is $46,000 per year. This ranges by province between $30,000 to $60,000. We used $46k for this calculation.

Average Teacher's CPP

Everyone's CPP is personal and unique. Using teacher's average salaries and the Canadian governement Retirement Income Calculator, we can see that teacher's are likely to receive close to the maximum benefit of $16,368/year, as offered at the end of 2024.

Teacher's OAS

It is assumed that a Canadian teacher is entitled to the full OAS benefit. So this would be $9256/year at the end of 2024.

Teacher's RRSPs

Figuring out average RRSPs is tricky. For this article, we used the yearly average contribution by age group and yearly average contributions by salary range to build an average RRSP account balance of $407,000 at age 65. It was assumed a modest 6% growth rate.

Teacher's TFSAs

TFSAs are faily new in Canada, only being established in 2009. Research has shown that the TFSA contribution is close to equal regardless of income level. According the Bank of Montreal, the average TFSA balance in 2024 is $41,500, which is what we are using.

Other Assumptions

To figure out the average retirement income, we have to make several other assumptions such as:

- Teachers will start retirement at age 65.

- Inflation will hold steady at 2.1%.

- Investment growth during retirement will be 4%.

- Due to their lifelong resilence, teacher's will live to the age of 90.

- Income needs are fixed at the same value for the whole retirement period.

- An income goal of 110% is targeted to provide a safety margin allowing for fluctuations in inflation, investment growth, age of death, and other life-changes.

- It is assumed that the teacher is a single person. You can imagine that retirement income could be significant more for a couple.

The Final Result

Using the Retirementize retirement income calculator, we can plug in all these income sources and assumptions. Looking at each province with taxes and using the population distribution, we can estimate the average retirement income for teachers as $69,500 per year after taxes.

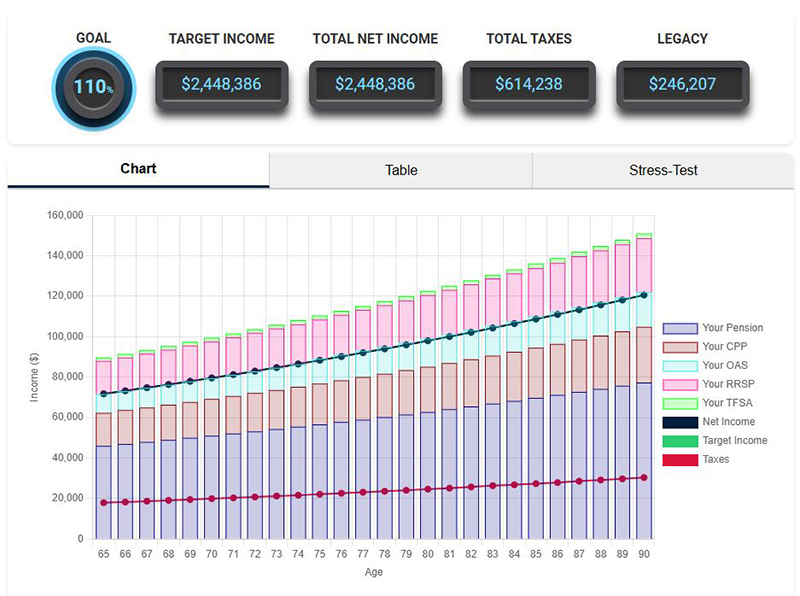

The Retirementize calculator results for this scenario in Ontario are shown in the figure below.

Fun Facts

- Teacher pensions vary widely by province. For example, a teacher in Ontario might retire with an annual pension close to $50,000, while teachers in smaller provinces like Newfoundland and Labrador may receive closer to $35,000–$45,000.

- Many Canadian teacher pension plans offer a "bridge benefit" that supplements the teacher's income until age 65, when full CPP benefits are available. This bridge benefit helps bridge the gap before other retirement income kicks in, enhancing overall retirement security for teachers.

- Some teacher pensions, such as Ontario’s, include annual cost-of-living adjustments to help maintain purchasing power through inflation. Not all provinces offer these adjustments, so retirement income may differ significantly based on whether a teacher's pension is indexed for inflation.

- Teachers in Canada commonly retire around age 58–60. This is often younger than many other professions due to structured pension benefits that incentivize early retirement after a long service period of 25–35 years.

- The majority of teacher pensions in Canada are defined benefit (DB) plans, which provide guaranteed income based on service years and salary, offering predictable income compared to defined contribution (DC) plans. This structure makes teacher pensions relatively secure compared to many other professions, where income is more tied to personal retirement savings and investments.

Conclusion

Teachers in Canada have devoted their careers to developing the young minds of Canadians. At the end of their hard-working career, they are rewarded with an average retirement income of about $69,500 per year after tax. Depending in the provice, this could be about $90,000 before tax, which is a pretty substantial and impressive retirement fund.