Get Started with Retirementize: How-To Guide

Here are some instructions on how to create your plan, visualize and interpret the data, and optimize your plan with what-if scenarios.

Notes:

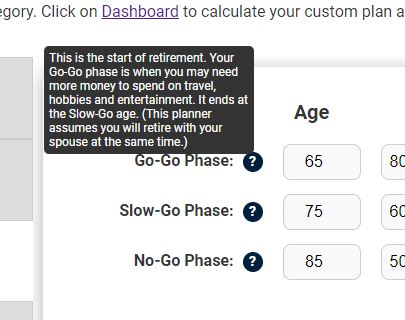

- Many fields has a next to them. When you hover over it, it will display a tooltip. For example:

- Data is stored automatically in cookies. If you retrict cookies then this site will not work well for you. If you clear your cookies, then you will need to re-enter the data.

First thing First

Pick your country. This is needed to ensure you are offered the correct retirement income sources, and taxes are processed correctly.

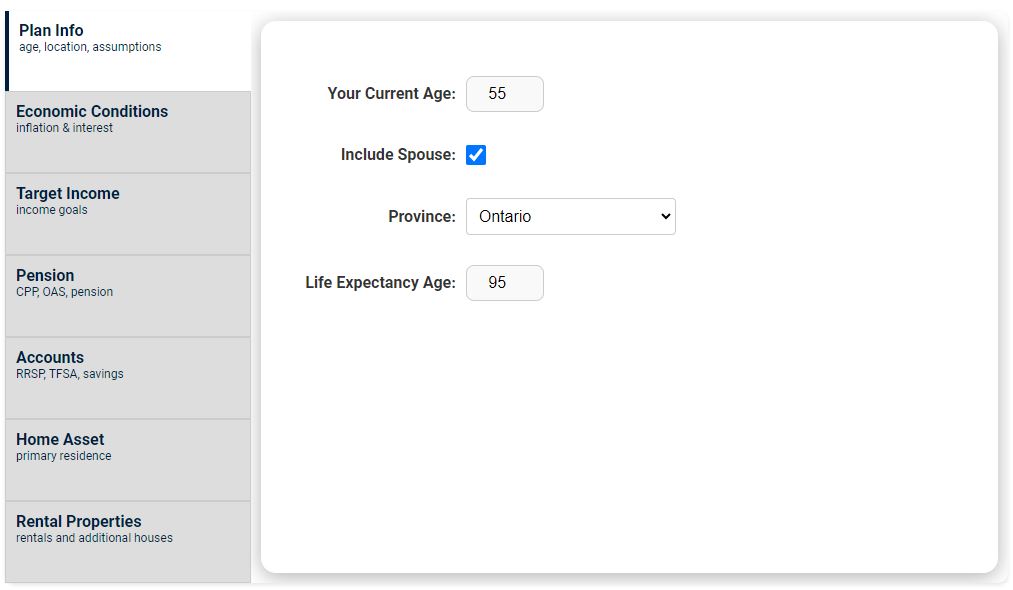

Plan Info

Under the Plan menu, click the "Plan Info" tab. Enter your current age, select if this plan will include a spouse, selected you State or Province, and choose your life expectancy.

Assumptions:

- Your spouse is assumed to be the same age as you and retire at the same time as you. (This feature will be updated in the near future.)

- Your spouse is assumed to have the same life expectancy. (This feature will be updated in future advancements.)

Notes:

- Your spouse data entry fields will be disabled if you do not select the "Include Spouse" checkbox.

- The State or Province you choose will be used to estimate your taxes.

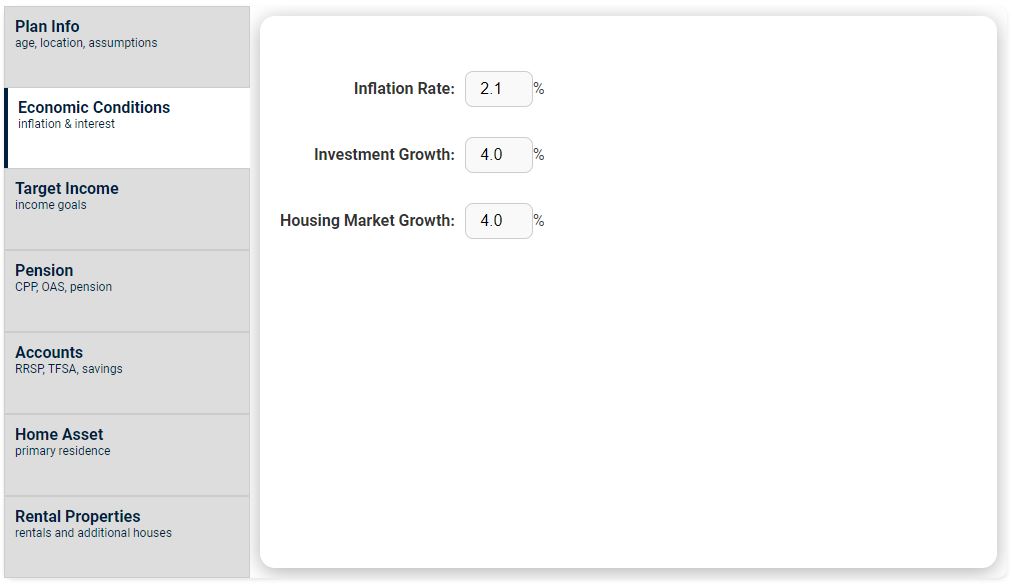

Economic Conditions

These setting give you flexibility on inflation and investment growth.

- Inflation Rate: Yearly rate of inflation. This will impact your target income and pensions adjusted by inflation.

- Investment Growth: Yearly rate of investment growth. This percentage will be applied to all investment and savings accounts.

- Housing Market Growth: Yearly percentage growth rate of the housing market. This will impact the value of your home and rental properties.

Assumptions:

- The single interest rate will be applied to all investment accounts and your savings.

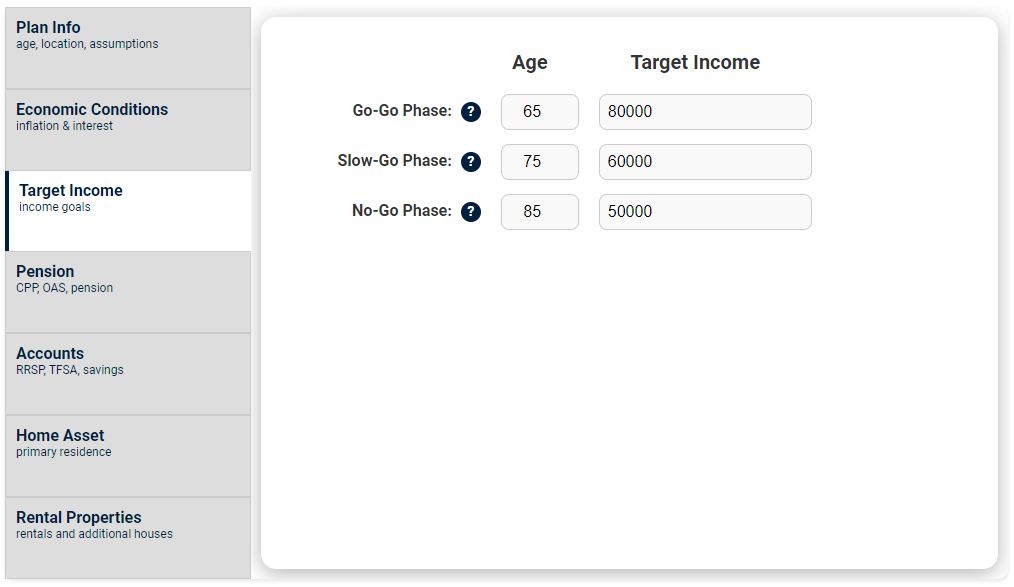

Target Income

Our needs change as we move through our golden years. So, our retirement has been divided into three phases: Go-Go, Slow-Go and No-Go.

- Go-Go Phase: The early years of your retirement, when you can do the most and live unassisted. These are the best years to (fast) travel, play sports, and be more active.

- Slow-Go Phase: This period of time likely reduces your fast travel, and you have become more sedentary.

- No-Go Phase: In this phase you are starting to need support for living. Health concerns and assisted-living conditions should be considered.

Assumptions:

- The yearly income you put here is in today's dollars. This means, how much yearly income you anticipate needing if you started this phase today.

- The Inflation Rate will be used to project and yearly-increase these ammounts.

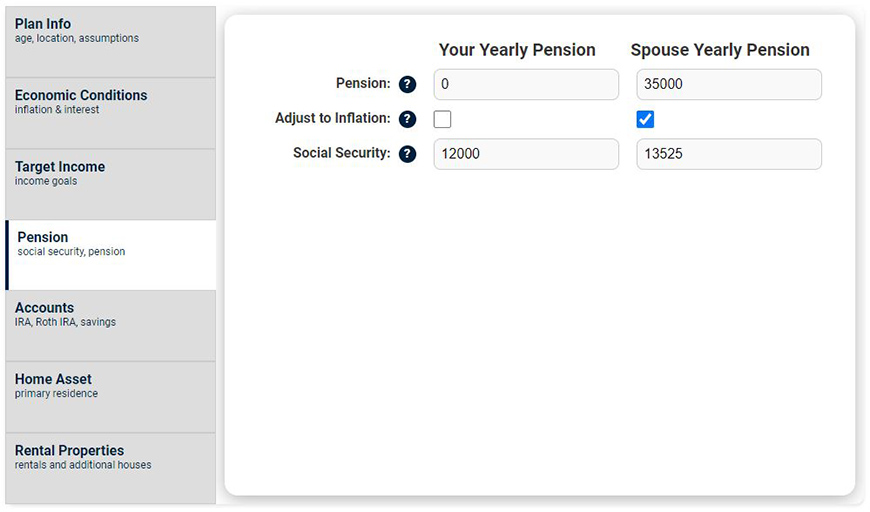

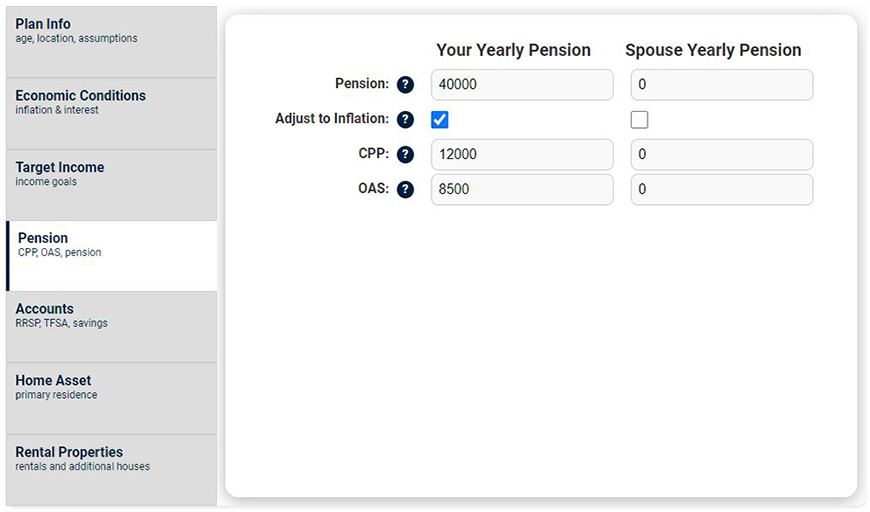

Pension

Under the Pension tab you can enter the difference sources of pension. Some of these options are different for Americans and Canadians.

- Pension: Typically a company or governement defined benefit pension plan. Enter your yearly pension income before tax in today's dollars.

- Adjust to Inflation: Check this box if you pension will increase with inlfation. (Most pensions do adjust to inflation.)

- Social Security: (United States) Enter your yearly estimated income from social security in today's dollars when taken at age 67.

- CPP: (Canada) This is your yearly income from the Canada Pension Plan. Enter it in today's dollars when taken at age 65.

- OAS: (Canada) This is your yearly income from Canada's Old Age Security. Enter it in today's dollars when taken at age 65.

Assumptions:

- Social Security is entered when taken at age 67. This can be changed in the Dashboard.

- CPP and OAS is entered when taken at age 65. This can be changed in the Dashboard.

- OAS clawback is not currently considered. (Part of future development.)

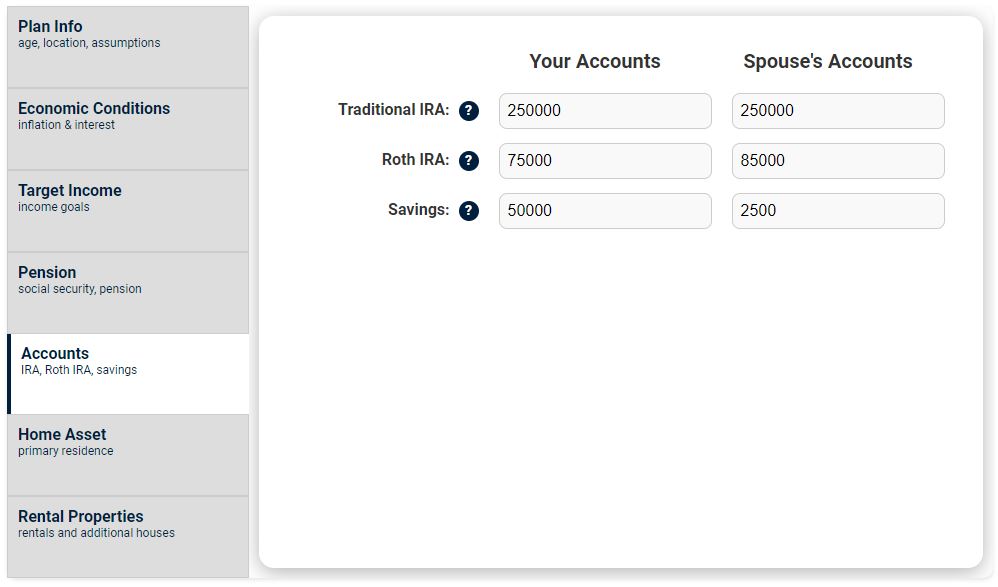

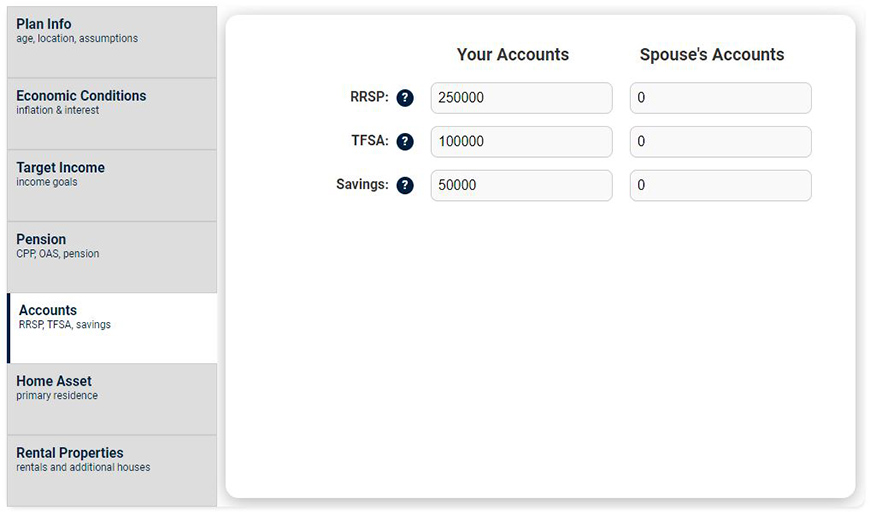

Accounts and Savings

You will enter your registered and non-registered accounts under the Accounts tab.

- Traditional IRA: (United States) Enter the total ammount of money you will have in IRA account at the time of retirement.

- Roth IRA: (United States) Enter the total ammount of money you will have in your Roth IRA account at the time of retirement.

- Savings: (United States & Canada) Enter the total ammount of money you will have in your Savings accounts at the time of retirement.

- RRSP: (Canada) Enter the total ammount of money you will have in your RRSP account at the time of retirement.

- TFSA: (Canada) Enter the total ammount of money you will have in your TFSA account at the time of retirement.

Assumptions:

- These account balances are all provided in future dollars, meaning you have to estimate the actual balance at the time of retirement.

- RRIF manditory withdrawals have not been considered.

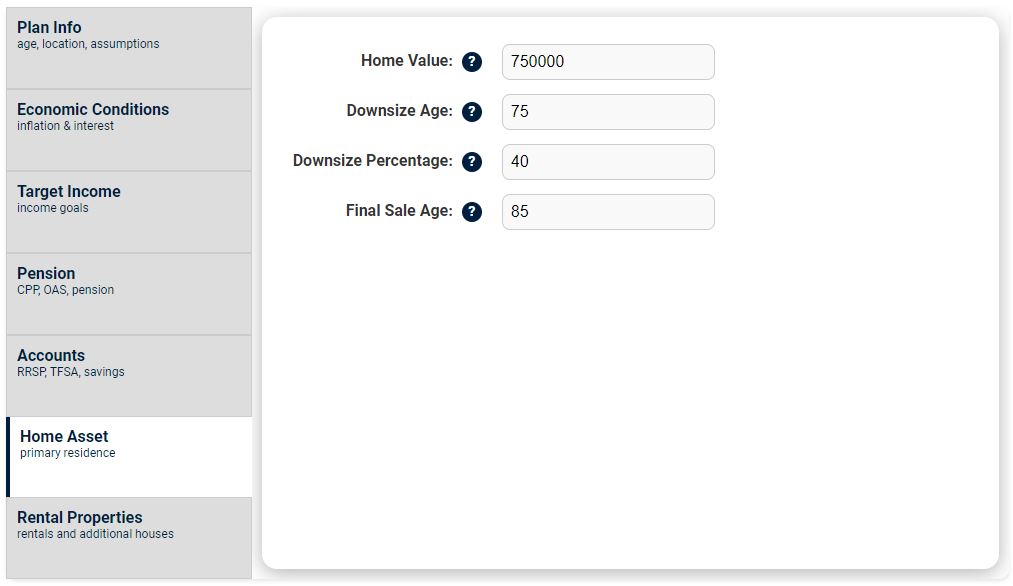

Home Asset

You can enter the value of your home, when you will downsize, and when you sell it completely.

- Home Value: Enter the value of you home at it's current value. Subtract any ammount oweing.

- Downsize Age: The age when you expect to sell your home.

- Downsize Percentage: The percentage of the house you will sell. For example, if you house is worth $500,000 and you want to downsize to buy another house for $300,000 and keep $200,000, then you would enter 40% (i.e. $200,000/$500,000). If you enter 100%, then you are saying you will sell your home and keep everything for retirement income.

- Final Sale Age: The age when you will sell the remaining equity from your home. If you entered 100% in the Downsize Percentage, then there is no need for a Final Sale Age.

Assumptions:

- It is assumed your home is fully paid off and the value is how much you will get if you sold your home today. If you still owe money on your home, subtract it from the Home Value.

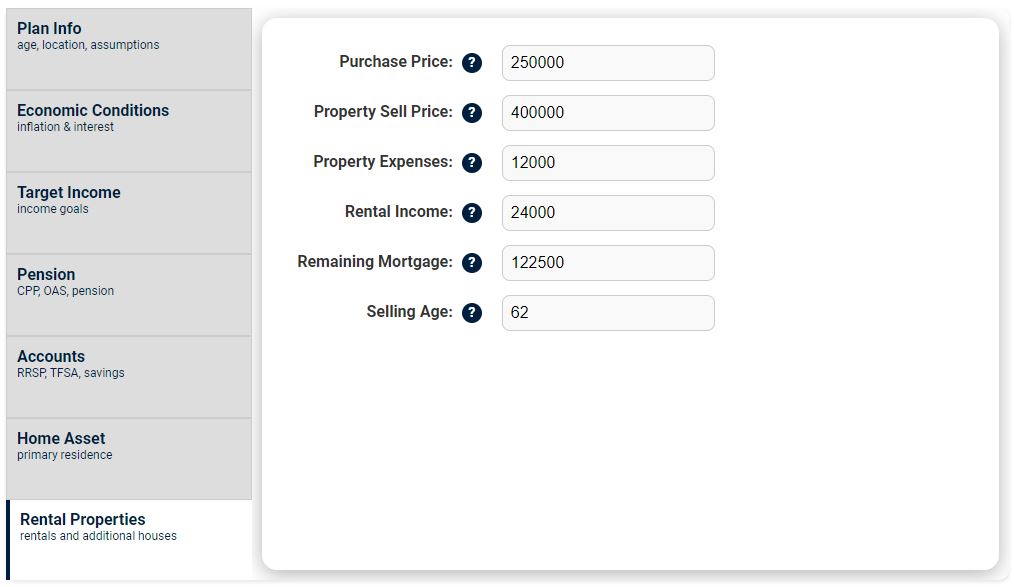

Rental Properties

Here you can enter your rental property income.

- Purchase Price: The original price you paid in the original ammount (no inflation).

- Property Sell Price: Value of the property in today's dollars. (Housing Market Growth rate will be applied.)

- Property Expenses: The costs for lawyer fees, realestate fees, and capital improvements. This ammount will be taken off the profits before capital gains is applied.

- Rental Income: Yearly income earned from rent while you still own and rent the property. It is entered in today's dollars, and inflation is applied.

- Remaining Mortgage: The ammount remaining on the mortgage or loans that will be subtracted from the profits.

- Selling Age: The age when you will sell the rental property. If it is left blank, set to zero, or set higher than your life expectancy, then this property will not be sold.

Assumptions:

- The proceeds from the property will be added to your savings.

- Currently, only one property can be entered. So you can combine all your properties together, but they would have to be sold at the same time. This will be addressed in future releases.

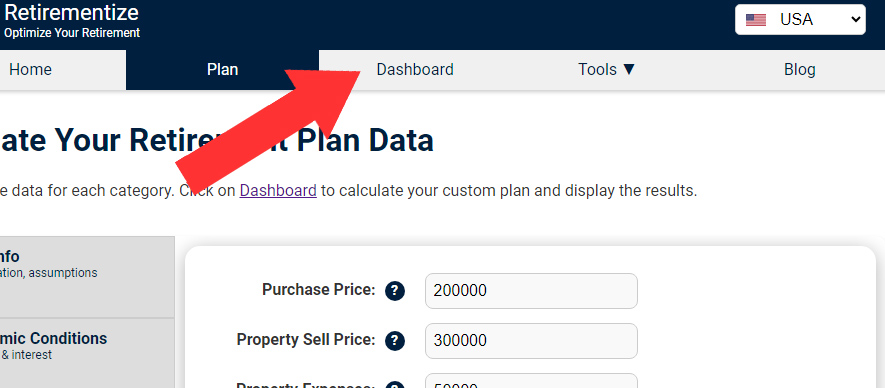

Go To Dashboard

Click on the Dashboard menu to see your results.

Notes:

- Data from the Plan is stored in Cookies to be used in the Dashboard. We do not store or use you data for anything. See our Privacy Policy.

Dashboard

The Dashboard has four sections.

- Progress Bar: Top section showing progress and summary.

- Chart: The retirement plan with income withdrawal strategy.

- Table: The raw data shown in the Chart.

- Stress Test: What-if scenarios that can be show you how the plan could change under various extreme conditions.

Progress Bar

The Progress Bar shows 4 pieces of data about you plan. It will update automatically if you change data from the Plan settings, or is you select a Stress-Test scenario.

- Goal: Shows the percentage of reaching your overall retirement finacial goal. 100% means that you have met your after-tax income targets every year. If it is greater than 100%, then you have money left over at the end of you plan.

- Target Income: The total ammount of money you need for the entire retirement plan.

- Total Net Income: Total ammount of money you have spent throughout retirement.

- Total Taxes: Total sum of taxes paid during all retirement years.

- Legacy: Everything you own that is left over at the end of your retirement period.

Chart

The Chart is the main attraction. Here you can see a detailed retirement withdrawal strategy for each year of retirement. Here are some features:

- Color-Coded Data: Each account has its own color, and indicated in the legend.

- Mouse-Over: The data will be highlighted when you pass the mouse over it, or click on it.

- Target Income: Your Target Income is shown with the solid green line.

- Net Income: Your after-tax (net) income is shown with the black line.

- Taxes: Your yearly taxes are indicated with the solid red line.

- Inflation: The ammounts increase each years as a result of inflation.