Can I Retire at 60 with $500K?

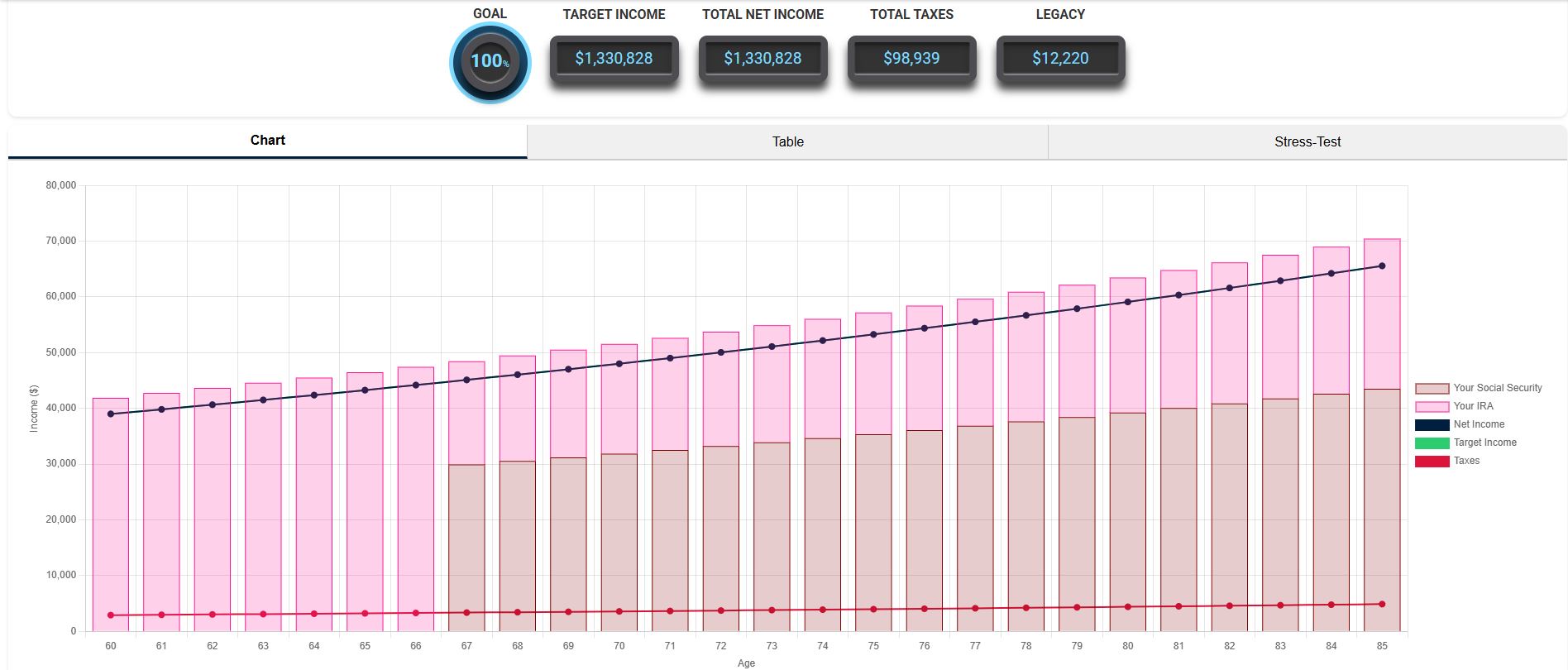

If you’ve saved $500,000 and are asking yourself, “Can I retire at 60 with $500K?”, the short answer is yes—but it depends on how you live, how you invest, and how long you live. Based on projections from Retirementize, a single retiree with $500,000 in savings, collecting the average Social Security benefit of $1,860 per month, could expect around $39,000 per year in income until age 85. If life expectancy extends to 90, the yearly income drops slightly to about $37,000. Let’s dive into the numbers, scenarios, and lifestyle choices that can make this work.

Understanding the Retirement Math

When you retire, your spending is funded by a mix of Social Security and withdrawals from your savings. A commonly discussed guideline is the 4% rule, which suggests withdrawing 4% of your portfolio each year to make it last 30 years. With $500K, that’s about $20,000 per year. Add in $22,320 from Social Security, and you’re looking at ~$42,000 per year, before taxes and inflation.

But averages can be misleading. According to the Bureau of Labor Statistics, the average annual spending for households headed by someone 65 or older is around $50,000. That means $39K–$42K is slightly below average but achievable, especially if you live in a state like Florida with no income tax.

In the example plan shown in the graph above, these are the assumptions:

- Start Retirement Age: 60

- Life Expectancy Age: 85

- Single, non-married

- Inflation: 2.1% anually

- Investment Growth: 4% (modest)

- Social Security: $1860/month

- Live in no-income tax state

The Role of Social Security

Social Security is a game changer. If you claim at 62, your benefit is reduced, but you start receiving it earlier. If you wait until full retirement age (67), your benefit grows by about 30%. In our scenario, we assume the average $1,860/month beginning at 67. That’s a reliable $22,320 income floor. Learn more in our article: What is Social Security?

How Far Does $500K Go?

The Retirementize chart shows that with $500K, you can expect about $39K in annual income through age 85. If you live to 90, the annual income falls to about $37K. This is because the money needs to stretch across five more years, while Social Security remains constant. That’s why life expectancy is a critical assumption in retirement planning. Tools like the Retirement Withdrawal Calculator can help you run your own scenarios.

Where Should the $500K Be Parked?

How you invest your $500K is just as important as how much you’ve saved. Here are some common approaches:

Scenario A: Conservative

Allocate 50% to bonds/CDs, 30% to dividend-paying stocks, and 20% to cash. This prioritizes stability, but the risk is your money won’t grow enough to outpace inflation.

Scenario B: Balanced Growth

Split 60% into diversified index funds, 30% into bonds, and 10% into cash. This mix balances growth and safety, and is consistent with the Retirementize 4% growth assumption.

Scenario C: Income-Focused

Use 40% in dividend growth stocks, 40% in bonds/annuities, and 20% in REITs. This generates regular income but can be sensitive to interest rates.

Scenario D: Partial Annuity

Convert part of your savings into an annuity for guaranteed lifetime income, while keeping the rest invested for flexibility. Learn more in our article What is an Annuity?.

Lifestyle Choices That Matter

Income is one side of the equation, expenses are the other. A frugal retiree with no mortgage may thrive on $39K/year. Someone still paying rent or wanting to travel extensively will find it more challenging. Check out our guide on Frugal Retirement for ideas to stretch your dollars further.

What Happens if You Live Longer?

If you live to 85, the plan works at $39K/year. If you live to 90, the annual income falls to about $37K. Past 90, income shrinks further, though Social Security continues. That’s why longevity risk is one of the biggest factors in retirement planning.

Risks to Watch Out For

- Market downturns early in retirement (sequence of returns risk).

- Inflation higher than 2.1%.

- Healthcare costs before Medicare kicks in at 65.

- Unexpected expenses like family support or home repairs.

Strategies to Strengthen Your Plan

- Delay Social Security for a larger benefit.

- Work part-time between 60–62 to preserve savings.

- Consider rental properties for retirement income.

- Use Roth conversions before Required Minimum Distributions (RMD).

- Downsize or relocate to a lower-cost area—see our post on Least Expensive States to Retire In.

Fun Facts

- The average retirement age in the U.S. is 62.

- About 25% of Americans have no retirement savings at all.

- The average Social Security benefit in 2025 is $1,860 per month.

- Healthcare is one of the largest expenses in retirement, averaging $315,000 per couple over a lifetime.

- Florida remains the most popular state for retirees, with no state income tax.

Conclusion

So, can you retire at 60 with $500K? Yes—but expect a modest lifestyle. With Social Security and careful withdrawals, you can live on ~$39K per year until age 85, and around $37K per year if you live to 90. The key is keeping expenses low, investing wisely, and using strategies like delaying Social Security or working part-time in early retirement. It’s not luxury, but it’s comfortable and achievable. The best step you can take now is to run your own numbers with the Retirementize calculator and see how different choices affect your future income.