Can I Retire with 2 Million?

If you have $2 million saved and are wondering, “Can I retire with 2 million?”, the short answer is yes. A single person retiring at age 67 today with $2 million in a 401(k) plus the average Social Security benefit of $1,976 per month can absolutely live well into retirement. Using Retirementize.com, we crunched the numbers with the same inputs but in two different states: high-tax California and no-income-tax Florida. The results? In California, you can expect about $102,000 per year after tax. In Florida, that jumps to $110,000 per year after tax. This article explores how that works and what it means for your retirement planning.

Setting the Stage: The Retirement Scenario

Before diving into the state-by-state comparison, let’s define the baseline scenario. We’re assuming:

- Age 67 at retirement (the current full retirement age for Social Security for many Americans).

- A nest egg of $2,000,000 in a 401(k), meaning withdrawals are fully taxable at both federal and state levels.

- Average Social Security monthly benefit of $1,976 (about $23,712 per year), based on the Social Security Administration’s 2024 data.

- An expected lifespan until age 90, providing 23 years of retirement income planning.

- Yearly inflation set to 2.1% and a modest investment growth of 4% annually.

This setup mirrors many retirees’ situations—significant tax-deferred savings, steady Social Security, and the need to maximize after-tax income for a comfortable lifestyle. To model outcomes, we use the Retirementize online income calculator, which optimizes withdrawals for after-tax spending.

Example 1: Retiring in California (High-Tax Scenario)

California has the highest state income tax rates in the U.S., topping out at 13.3% for high earners. While not every retiree will hit that bracket, even moderate withdrawals from a $2 million 401(k) can push you into significant state tax liability.

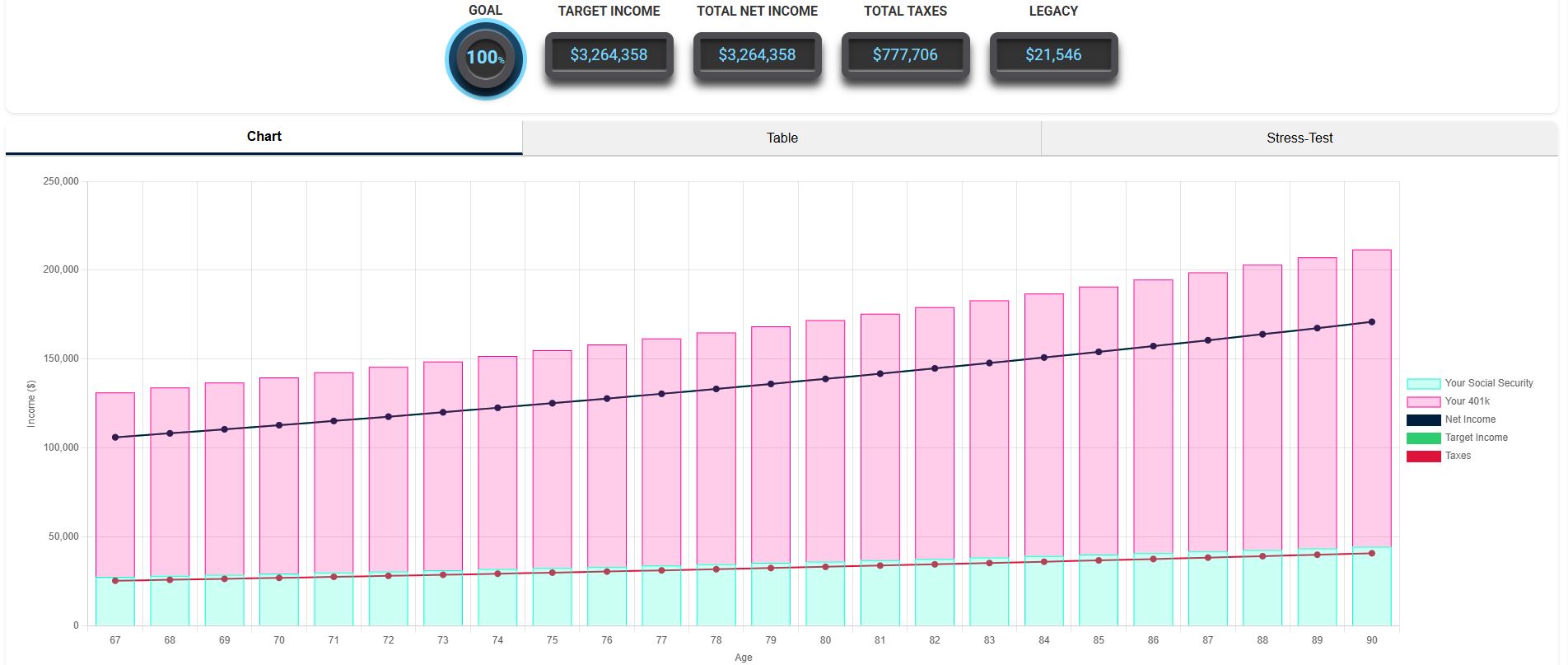

Running our $2 million retirement scenario in Retirementize.com with California’s tax rules, the results are clear: about $106,000 per year after tax is sustainable until age 90. Here is an example of the Retirementize results.

In California, a portion of your Social Security is taxed at the federal level (state excludes Social Security income), but the bulk of your withdrawals from the 401(k) are fully taxable at both federal and state levels. That eats into your take-home pay.

Still, $106,000 per year after tax is nothing to sneeze at. That equates to about $8,500 per month in spending power—plenty for housing, healthcare, food, travel, and entertainment. But if you’re dreaming of maximizing every dollar, location may matter.

Example 2: Retiring in Florida (No Income Tax Scenario)

Florida is one of the most tax-friendly retirement destinations. With no state income tax, retirees there keep more of their withdrawals. Housing and insurance costs may still be higher than some areas, but the tax savings are undeniable.

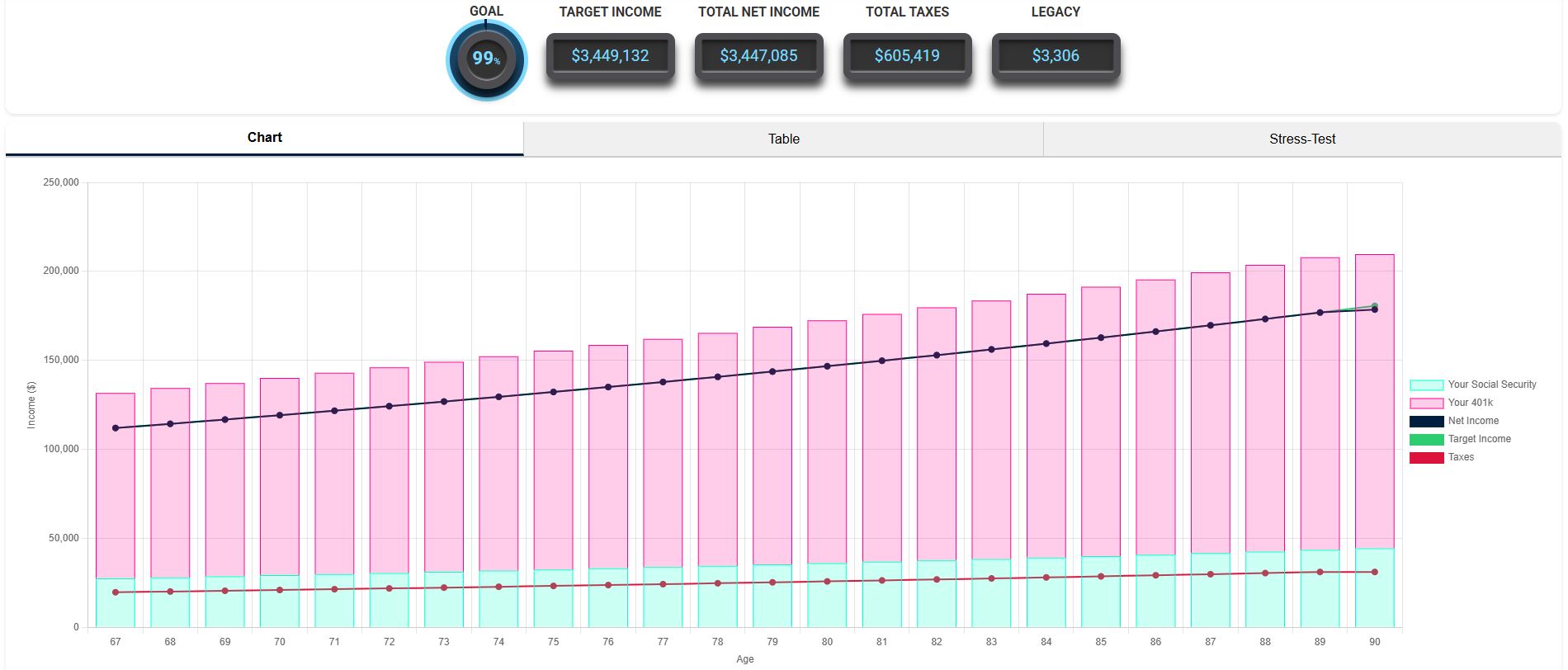

Running the same $2 million scenario in Retirementize.com under Florida’s tax rules results in approximately $112,000 per year after tax. That’s an extra $6,000 annually compared to California, or nearly $200,000 over a 23-year retirement.

In other words, simply changing your state of residence could fund additional vacations, a second home, or cover rising healthcare costs without ever needing to save another dime.

Comparing the Two: California vs Florida

Here’s a side-by-side look at the differences:

| State | After-Tax Annual Income | Total Income(Age 67–90) | Total Taxes(Age 67–90) |

|---|---|---|---|

| California | $106,000 | $3.26 million | $778k |

| Florida | $112,000 | $3.45 million | $605k |

The takeaway? Geography matters. Taxes can meaningfully impact your lifetime income. A retiree in Florida keeps nearly $200,000 more in disposable income compared to one in California, even though both started with the same $2 million nest egg.

What This Means for Your Retirement Planning

So, is $2 million enough to retire? Absolutely. But as we’ve seen, location significantly affects how far your money stretches. Here are key insights:

- Taxes matter: Use tools like the Retirementize online income calculator to model different state tax scenarios.

- Housing and healthcare: Beyond taxes, states differ in cost of living, property values, and healthcare expenses. See our article on aging in place vs assisted living for long-term planning considerations.

- Inflation risk: With inflation averaging 2–3% historically, that $106,000 or $112,000 will buy less over time. Smart withdrawal strategies help mitigate this.

- Lifestyle choices: If you plan to travel often, check out our article on the golden rules of retirement travel.

Fun Facts

- The average retirement savings for Americans aged 65–74 is just $426,000 (Federal Reserve, 2023)—far less than $2M.

- About 18% of Americans over 65 still work part-time or full-time (Bureau of Labor Statistics, 2024).

- The average annual Social Security benefit is about $23,712, making savings crucial to maintaining lifestyle.

- Florida attracts nearly 330,000 retirees each year due to its tax-friendly environment (U.S. Census Bureau).

- Healthcare can consume up to $315,000 for a couple in retirement, according to Fidelity’s 2024 Retiree Health Care Cost Estimate.

Conclusion

The question, “Can I retire with 2 million?”, has a resounding yes as its answer. Whether you live in California, Florida, or somewhere in between, $2 million plus Social Security provides a very comfortable retirement. But the difference in location highlights a critical point—taxes and cost of living can dramatically alter your outcome. Florida retirees enjoy roughly $200,000 more over their retirement than their California counterparts, all thanks to tax policy.

Your retirement success isn’t just about hitting a savings goal—it’s about optimizing withdrawals, minimizing taxes, and aligning your plan with your lifestyle goals. That’s exactly what the Retirementize online income calculator helps you do.

by Mark Briggs - November 2025

by Mark Briggs - November 2025