Canadian Retirement Without Savings

Retirement is a phase many look forward to—a time to relax, pursue passions, and enjoy the fruits of years of labor. But what if you find yourself approaching retirement age without substantial savings? In Canada, you're not alone. A 2023 survey revealed that 44% of Canadian pre-retirees aged 55 to 64 have less than $5,000 in savings. While this statistic might seem alarming, Canada offers several government programs and strategies to ensure that even without personal savings, you can still enjoy a comfortable retirement. Let's delve into these options and explore how you can make the most of your golden years.

Government Benefits:

Canada provides a robust safety net for its seniors through various government programs. Understanding these can help you maximize your retirement income.

Canada Pension Plan (CPP)

The Canada Pension Plan (CPP) is a contributory program that provides retirement income to eligible Canadians. If you've worked and contributed to the CPP, you're entitled to receive benefits starting as early as age 60. However, the standard age to begin receiving CPP is 65. The amount you receive depends on your contributions during your working years. As of October 2024, the average monthly payment for new beneficiaries at age 65 was $808.14, while the maximum monthly amount was $1,306.57.

Example: If you start receiving CPP at 60, your benefits will be reduced by 0.6% for each month before your 65th birthday, totaling a 36% reduction. Conversely, if you delay until 70, your benefits increase by 0.7% for each month after 65, resulting in a 42% boost.

Old Age Security (OAS)

The Old Age Security (OAS) pension is a monthly payment available to most Canadians aged 65 or older. Unlike the CPP, you don't need to have worked or made contributions to qualify. Eligibility is based on your age and residency in Canada. As of October 2024, the maximum monthly OAS payment was $615.37. However, high-income earners may face a clawback, reducing their OAS benefits.

Example: If your annual income exceeds the threshold (e.g., $93,454 in 2025), your OAS benefits will be reduced at a rate of 15% for every dollar above this limit. Once your income reaches approximately $157,490, your OAS is fully clawed back.

Guaranteed Income Supplement (GIS)

For low-income seniors, the Guaranteed Income Supplement (GIS) provides additional monthly income. To qualify, you must be receiving OAS and have an annual income below a certain threshold. The maximum monthly GIS benefit for a single individual was $923.71 as of October 2024. The amount decreases as your income increases and is recalculated quarterly based on changes to your income.

Example: A single senior with no other income sources could receive the full GIS amount. However, if they start earning additional income, their GIS benefits would decrease accordingly.

The Impact of Retirement Age on Your Income

Deciding when to retire significantly affects your income. Let's explore how the timing of your retirement can influence your financial well-being.

Early Retirement (Before 65)

Choosing to retire before 65 means you'll start receiving CPP benefits earlier, but at a reduced rate. For each month you receive CPP before 65, your benefits decrease by 0.6%, leading to a 36% reduction if you start at 60. Additionally, OAS benefits aren't available until 65, so retiring early means you'll need to bridge the income gap until then.

Example: If you're eligible for a $1,000 monthly CPP benefit at 65, taking it at 60 would reduce it to $640.

Standard Retirement Age (65)

Retiring at 65 allows you to receive full CPP and OAS benefits. This age is often considered the standard retirement age in Canada. Combining CPP, OAS, and potentially GIS (if you qualify) can provide a stable income base.

Example: A retiree receiving the average CPP payment of $808.14 and the maximum OAS payment of $615.37 would have a combined monthly income of $1,423.51.

Delayed Retirement (After 65)

Delaying retirement beyond 65 can increase your CPP benefits by 0.7% for each month you defer, up to age 70, resulting in a 42% increase. Similarly, deferring OAS can also boost your payments. This strategy can be advantageous if you continue working and don't need immediate access to these benefits.

Example: If you're eligible for a $1,000 monthly CPP benefit at 65, delaying until 70 would increase it to $1,420.

Retirement Example - Age 65

Let's say you're single and 65 years old and are eligible for 70% of the maximum CPP benefit which equates to $12,037/year (as of January 2025). (The CPP calculation is complex, but a a rough estimate says that 70% of CPP translates to earning an average yearly income of about $50,000.) If you take OAS at 65 then that would be an addition $8,300/year. Since this income total is less than GIS minimum income amount, you would be eligible for the maximum GIS benefit of $13,043/year. Even more exciting, the GIS is non-taxable.

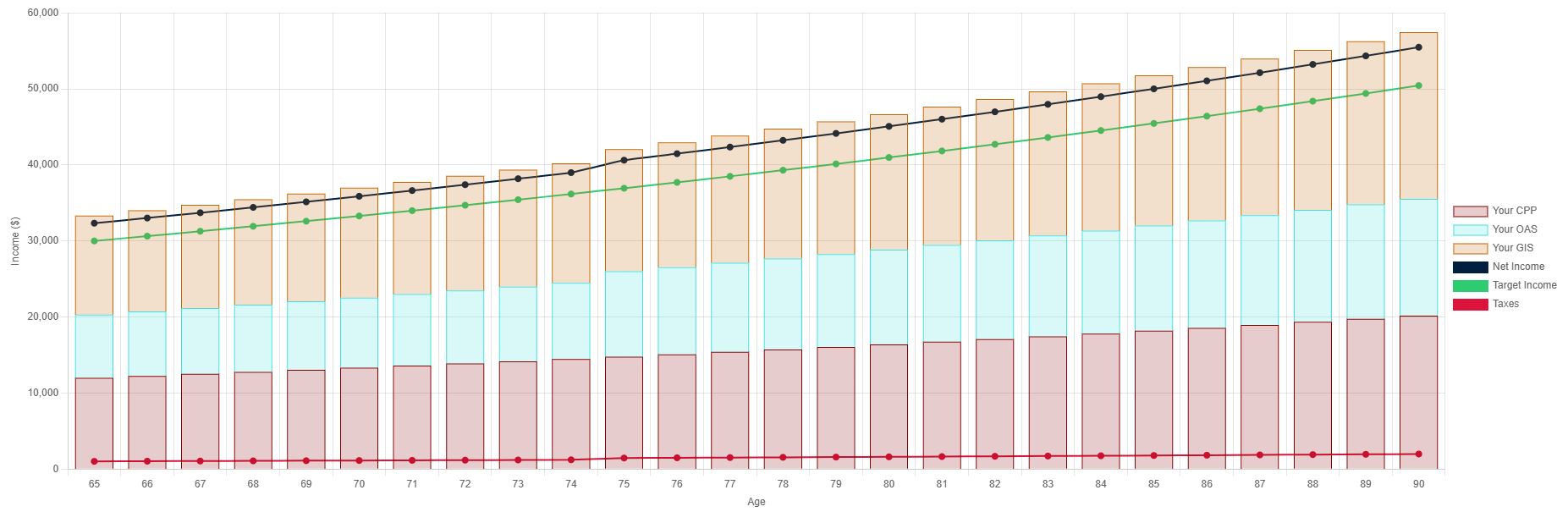

Plugging this info in the Retirementize Calculator we get the retirement income strategy shown in graph below. You would earn $33,380 per year before taxes, or take home $32,366 per year after tax. This amount would adjust for inflation each year.

Best Provinces to Retire in Without Savings

The cost of living and available benefits vary across Canada. Choosing the right province can significantly impact your retirement experience, especially when savings are minimal.

Cost of Living

Provinces like New Brunswick, Nova Scotia, and Prince Edward Island often have a lower cost of living compared to regions like Ontario or British Columbia. Housing, utilities, and groceries tend to be more affordable in these areas, making them attractive options for retirees on a fixed income.

Example: In 2024, the average rent for a one-bedroom apartment in Moncton, New Brunswick, was approximately $800, whereas in Toronto, Ontario, it was around $2,300.

Healthcare Considerations

Access to healthcare is crucial for retirees. Provinces like Quebec and Alberta offer additional senior-focused healthcare benefits, which can help reduce medical expenses. Each province has different wait times for procedures and availability of specialists, so it’s essential to factor in healthcare accessibility when deciding where to retire.

Income Tax Considerations

Income tax varies by province. For instance, using the example above, you would pay $1014 total taxes in the first year, $1284 in New Brunswick, $631 in Alberta, $1438 in Newfoundland, and $1650 in Nova Scotia. As you can see, it could amount to a $1000 per year difference in your pocket!

Supplemental Income Sources for a No-Savings Retirement

-

Part-time work or gig economy jobs (e.g., tutoring, Uber, freelancing)

-

Downsizing or house hacking (renting out a room, moving to a cheaper area)

-

Reverse mortgages: A lifeline or a trap?

-

Government assistance programs for seniors

-

Side hustles tailored for retirees (e.g., online businesses, consulting)

Budgeting for a Frugal but Comfortable Retirement

-

Essential vs. non-essential expenses: Cutting costs wisely

-

Free or low-cost entertainment and community programs

-

Grocery and healthcare savings tips

-

Affordable travel options for retirees

Fun Facts About Retirement in Canada

-

How many Canadians retire with no savings?

-

The average retirement income for seniors in Canada

-

How much seniors spend per year on average

Conclusion

Yes, you can retire in Canada without savings, but planning is key. Government benefits provide a foundation, but supplemental income and smart budgeting help maintain a better quality of life. Final tips for making the most of a no-savings retirement include using available resources and planning strategically.