Can You Retire with $1,000,000 in Your RRSP?

How comfortably can you retire as a hardworking Canadian with an RRSP nestegg of $1,000,000? Well, the data says you can live off of $55k per year (after-tax) as a single retiree. Let's explore...

Is $1,000,000 Enough for Retirement?

This question is so multi-dimensional. There are so many factors to consider: what is your retirement age, how much CPP will you collect, what are your salary needs, how long do you expect to live, what will inflation be, how agressive is your investment profile, do you have debt...? Let's look at a classic and simple scenario...

Example: $1,000,000 RRSP with 2% Inflation & 4% Growth

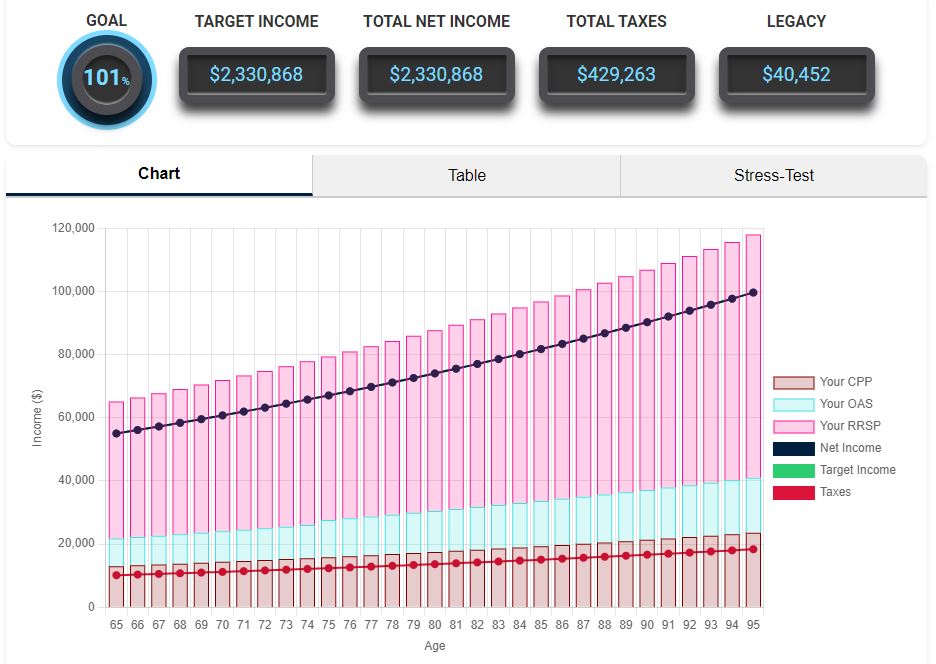

Let’s set up a scenario where you retire at 65 with $1,000,000 in your RRSP, live in Ontario, and receive 80% of the maximum CPP. Let's also assume a 2% cost-of-living inflation rate and a 4% RRSP investment growth. How much can you actually withdraw from the age of 65 to the age of 95?

Well, the answer is $55,000 per year after-tax (net income). Running the number through the Retirementize income calculator you get the following results:

These results show that you can take home an income of $55k after-tax and adjusted to inflation every year, withdrawing from RRSPs and paying the appropriate taxes (also adjusted to inflation).

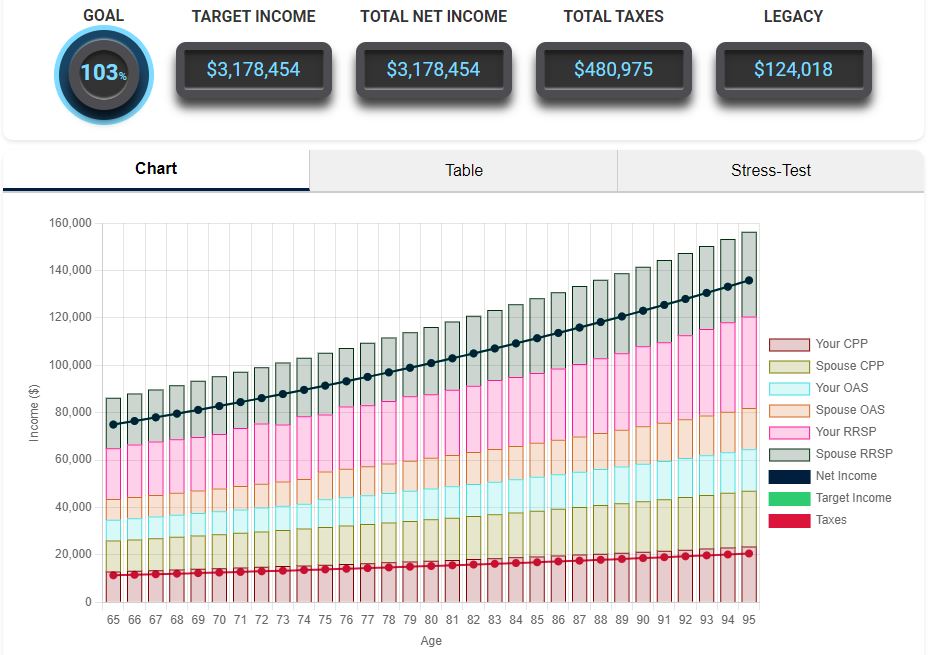

Couple Example: $1,000,000 RRSP in a Couple

Let's say the conditions are same but you are now in a couple, and your spouse is collecting CPP at 80% of max, and OAS. As you can see in the results below, you would easily live on $75k per year adjusted to inflations.

How to Build a $1,000,000 RRSP

Achieving a $1,000,000 RRSP requires a combination of disciplined saving, wise investments, and maximizing the tax benefits of RRSPs. Here are some strategies:

- Maximize Your Contributions: Contribute the maximum allowable amount each year to grow your RRSP faster. The 2023 contribution limit is 18% of your income, up to $30,780.

- Start Early: Compounding is your best friend. Starting your RRSP contributions early can result in significant growth over time, thanks to compound interest.

- Employer Matching: If your employer offers matching contributions, take advantage of it! This is essentially free money toward your retirement.

Another classic saving strategy is to start with $5000 when you are 25 years old. Increase your contribution ammount by 2% per year. With a modest 6% investment rate of return, you will expect over $1M at the age of 65.

For more details on retirement savings strategies, check out our blog on the retirement savings magic number.

Investment Strategies for Growing Your RRSP

Once you’ve got the savings started, the next step is to make that money work for you. Investing within an RRSP can be highly advantageous because of the tax-deferred growth. Here’s how to invest smartly:

- Diversify: Hold a mix of stocks, bonds, ETFs, and mutual funds to balance risk and return.

- Adjust Risk as You Age: As you get closer to retirement, consider gradually shifting your investments toward more conservative options to reduce risk.

- Rebalance: Review and rebalance your portfolio periodically to ensure your investment mix remains aligned with your risk tolerance.

If you’re looking for guidance on investment strategies, don’t miss our post on the four percent rule.

Tax Benefits of an RRSP

One of the biggest perks of contributing to an RRSP is the immediate tax deduction. By reducing your taxable income now, you can save more in the short term while your investments grow tax-free until withdrawal. This tax-sheltered growth is a powerful tool for building a $1,000,000 nest egg.

However, keep in mind that withdrawals from an RRSP in retirement are fully taxable. That’s why it’s critical to plan your withdrawals strategically to minimize your tax burden.

RRSP Withdrawal Strategies After Retirement

When you turn 71, you must convert your RRSP into a RRIF (Registered Retirement Income Fund) or purchase an annuity. A RRIF allows for flexibility in withdrawals, but there are minimum annual withdrawal amounts based on your age. For example, at age 65, the minimum withdrawal rate is 4%.

By planning your withdrawals carefully, you can optimize your tax situation and stretch your savings. Check out our detailed guide on RRIF withdrawals in our RRSP Withdrawal Tax Calculator post.

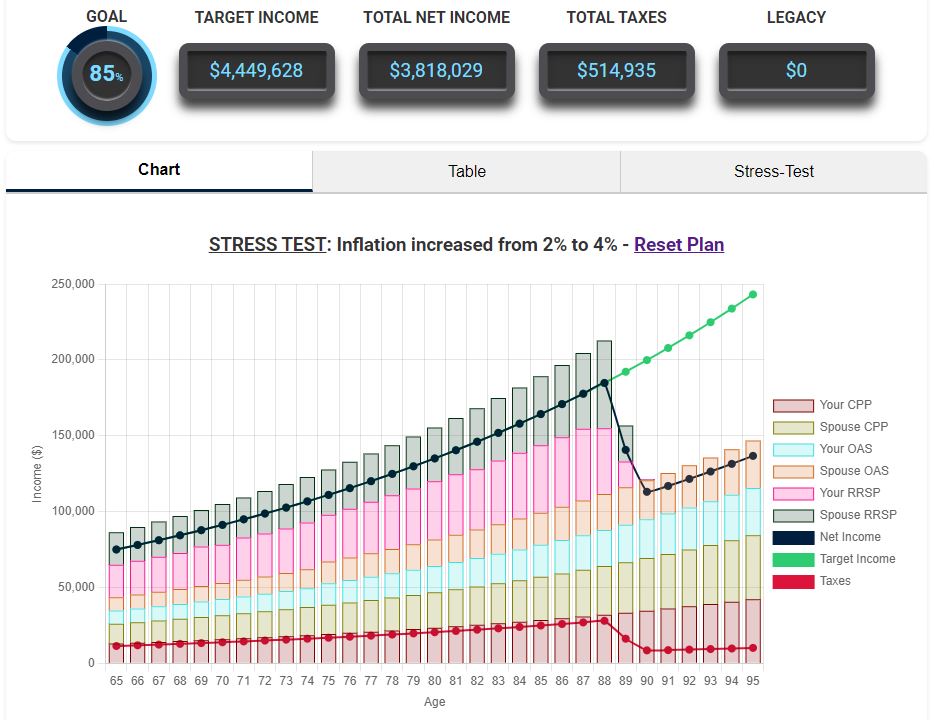

Impact of Inflation on a $1,000,000 RRSP

Inflation can erode the purchasing power of your savings over time. In our scenario with 2% inflation, even if your investments grow at 4%, the effective real growth rate is only 2%. This makes it essential to factor in inflation when calculating your withdrawal rates and long-term spending plans.

For example, let's look at the same example as the couple scenario above. Using the Retirementize Stress-Test tool, we can see that an inflation rate raised from 2% to 4% can impact your retirement plan dramatically.

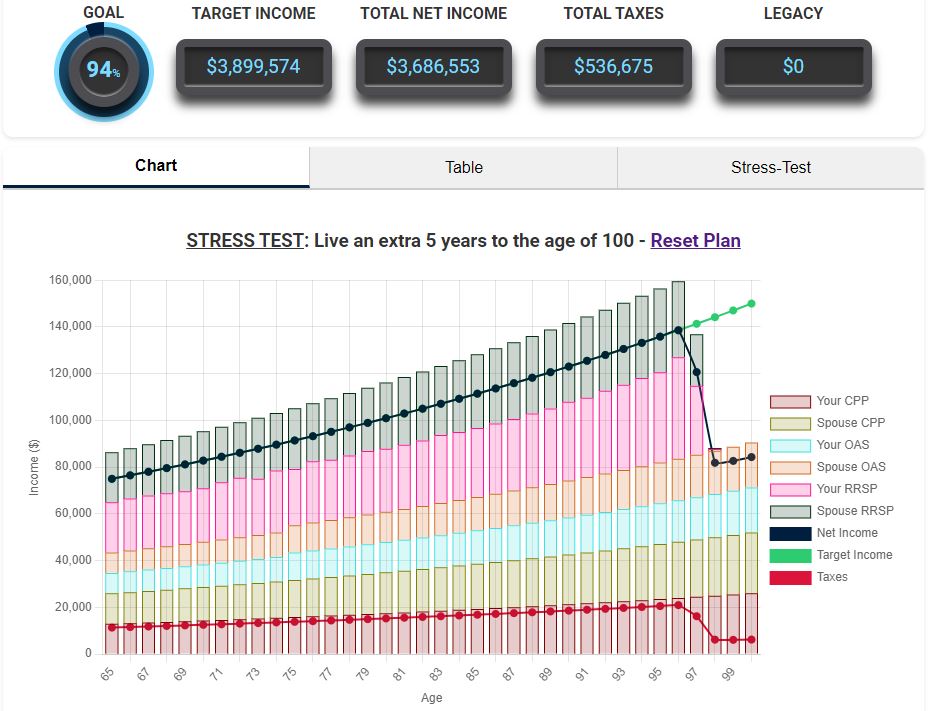

Longevity Risk: Will $1,000,000 Last Long Enough?

One of the biggest fears for retirees is outliving their savings. If you live well into your 90s, your $1,000,000 RRSP will need to last at least 25-30 years. If you withdraw 4% annually, that would equate to roughly $40,000 a year. While this sounds manageable, it’s essential to have a strategy in place to adjust your withdrawals over time, depending on market conditions and personal needs.

Continuing with the same example, if the couple lives an additional 5-years to 100 years-old, then there is risk of not meeting their retirement targets. The Retirementize example graph below shows this Stress-Test scenario.

Retirement Lifestyle: Budgeting on $1,000,000

Your retirement lifestyle will play a significant role in determining if $1,000,000 is enough. For example, if you plan on traveling frequently or maintaining an expensive hobby, your expenses will be higher than someone with a more modest lifestyle. If you have kids staying home longer or are supporting aging parents, you may need to adjust your budget to account for these factors.

Read more about the importance of careful retirement budgeting and how it affects your long-term financial health.

How to Maximize Your RRSP Beyond $1,000,000

If you’re fortunate enough to build your RRSP past the $1,000,000 mark, congratulations! However, even if you hit that milestone, it’s essential to ensure you manage those funds wisely. Continue to look for tax-efficient ways to draw down your savings and minimize fees.

Fun Facts

- Did you know only about 1% of Canadians have more than $1,000,000 in their RRSP?

- As of 2023, the maximum CPP payout at age 65 is around $15,000 annually, but most Canadians receive only about 70-80% of that amount.

Conclusion

While retiring with $1,000,000 in your RRSP is a fantastic achievement, it requires careful planning and smart withdrawal strategies to ensure that it lasts throughout your retirement. The combination of inflation, market returns, and lifestyle choices will all impact how far your savings can stretch.

Ready to start planning? Use our Retirementize online income calculator to help you map out your retirement and optimize your withdrawals. With the right strategies in place, your $1,000,000 RRSP can provide you with the retirement lifestyle you’ve always dreamed of!