Retirement Calculators Using Income Splitting

Can income splitting really change your retirement? The short answer is yes, it can save you thousands of dollars per year. There are many online retirement calculators that can calculate taxes, but only few have the option and complexity to optimize income splitting. Let’s put it to the test with a real-world example using the Retirementize online income calculator. In this case study, a couple living in British Columbia just retired at 65. One spouse has a $50,000/year pension, while both spouses receive CPP ($15,000/year each) and OAS ($8,880/year each). Their target is $90,000/year after-tax income, with inflation set to 2.1% and a planning horizon to age 90. We ran two scenarios — one with income splitting and one without. The difference? Tax savings of $2,382/year in today’s dollars and an improved ability to reach their retirement income goal. Let's dig into the details...

The Couple’s Retirement Setup

Here’s the base case:

- Spouse pension: $50,000/year

- CPP: $15,000/year each

- OAS: $8,880/year each

- Both age 65, just retired

- Plan until age 90 (25 years)

- Target after-tax income: $90,000/year

- Inflation assumption: 2.1%

- Province: British Columbia

We modeled their retirement cash flow with and without pension income splitting. Because the pension is concentrated in one spouse’s hands, splitting it with the lower-income spouse reduces overall household taxes.

Scenario 1: Without Income Splitting

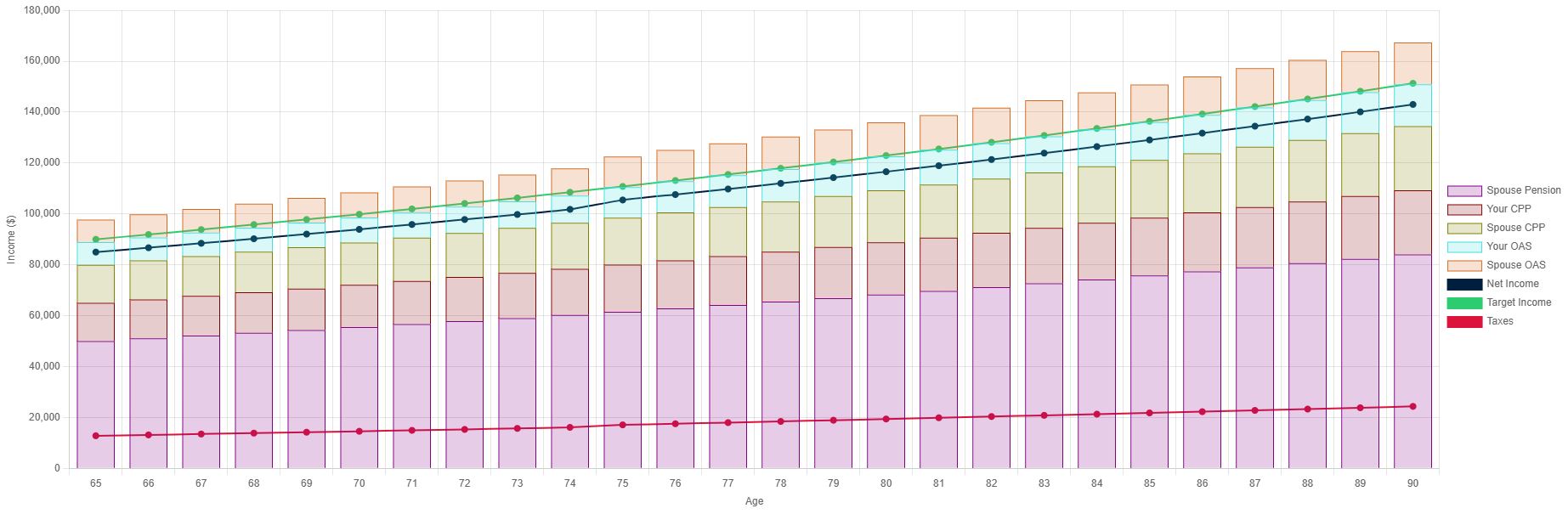

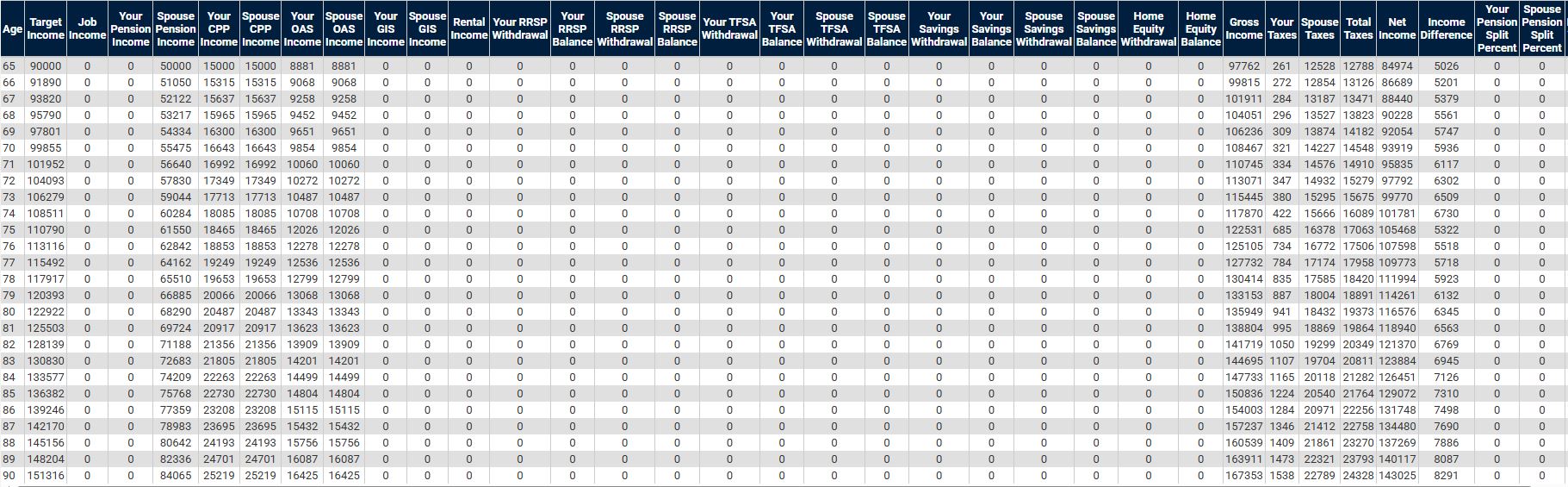

First, let’s look at what happens if the couple does not use income splitting. Retirementize creates a dashboard, a yearly income chart, and a detailed breakdown table. Below are the three outputs:

Summary Dashboard (No Splitting)

Yearly Income Chart (No Splitting)

Detailed Breakdown Table (No Splitting)

In this base scenario, the couple achieves 94% of their $90,000/year after-tax target. Taxes weigh heavily on the higher-earning spouse’s pension, reducing overall take-home income. The income split is 0%, meaning that the spouse carries all the tax burden from their pension, as you can see in the table.

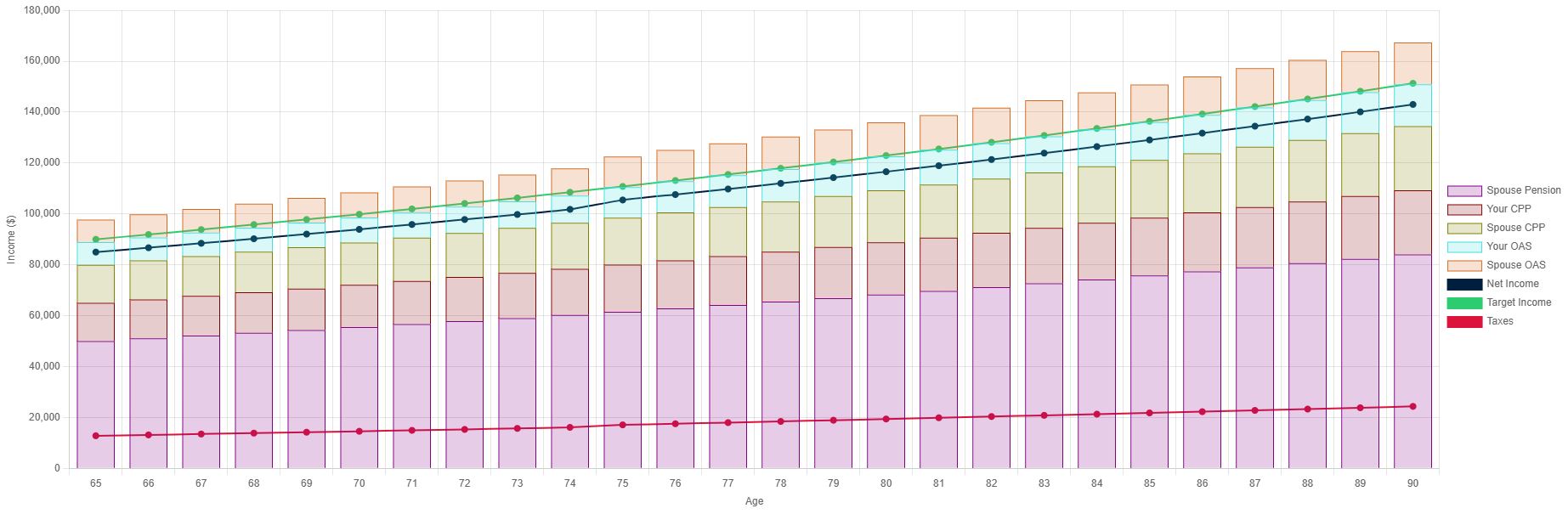

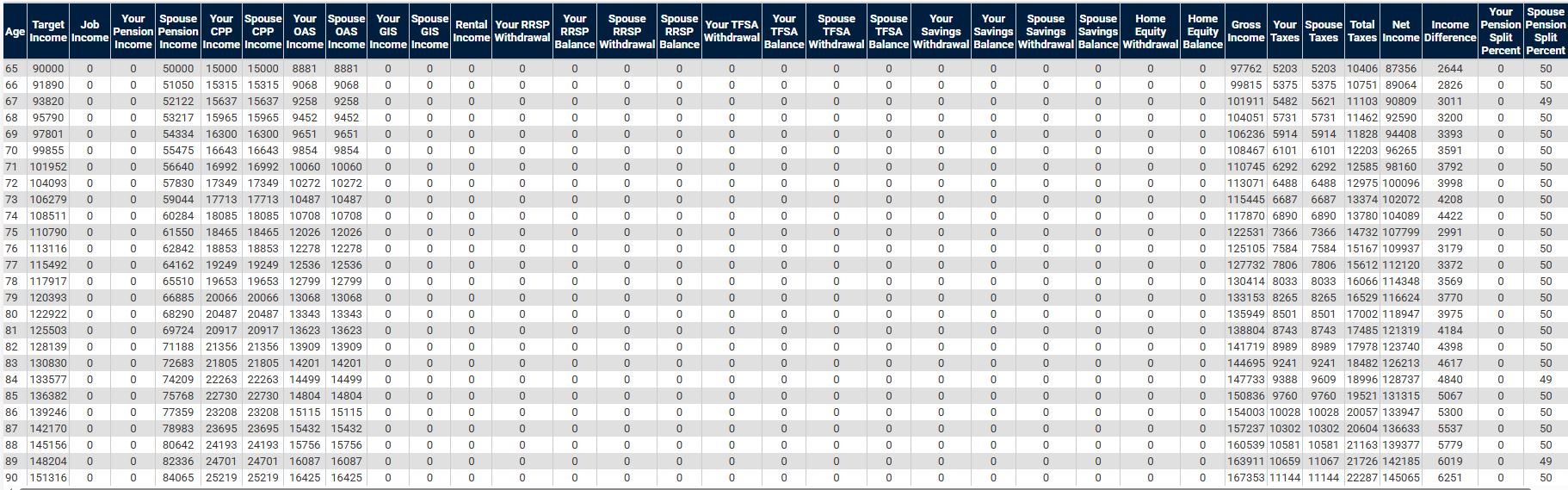

Scenario 2: With Income Splitting

Now let’s apply pension income splitting. The higher-earning spouse can allocate up to 50% of eligible pension income to the lower-income spouse. This evens out taxable income and reduces the household’s total tax bill.

Summary Dashboard (With Splitting)

Yearly Income Chart (With Splitting)

Detailed Breakdown Table (With Splitting)

With income splitting, the couple achieves 96% of their retirement target. The difference might seem small (just 2 percentage points), but that translates into $2,382 in tax savings each year, in today’s dollars. Over a 25-year retirement, that’s nearly $60,000 back in their pockets — money that can fund travel, healthcare, or a buffer against inflation.

What This Means for You

This case study shows why pension income splitting matters. When one spouse has a large pension and the other has lower income, splitting balances taxable income and reduces the household’s tax bill. Retirementize makes it easy to take advantage of income splitting as it figures out the optimal splitting percentage that minimize taxes. Just enter your pension, CPP, OAS, RRSPs, and other income sources, and the calculator handles the math — including taxes, OAS clawbacks, and inflation assumptions.

Conclusion

In our example, income splitting helped a British Columbia couple move closer to their retirement income target and save over $2,300 annually in taxes. For couples with uneven retirement income, the benefits can be even bigger. The bottom line: if you’re planning retirement in Canada with your significant-other, then you can’t afford to ignore income splitting. Use Retirementize to model your own numbers and find the best path to maximize your retirement income.