Retirement Planning Calculators: Income Planning vs. Savings Accumulation

You will need a differnt type of retirement calculator depending on where you are in your retirement journey. There are two primary categories of retirement planning calculators:

- Retirement Savings Accumulation

- Retirement Income Planning

Understanding the difference between these calculators can help you select the right one for your needs.

Retirement Savings Accumulation Calculators

Savings accumulation calculators focus on the wealth accumulation phase, helping you save and invest money leading up to retirement. Typically, it is the banks, lenders and financial planners who offer these tools to attract you to their site so that you will invest with them. These calculators show you if you're on track to meet your retirement goals. Some examples of these come from:

- Vanguard Retirement Planner

- Nerd Wallet

- Schwab Retirement Planner

The features of these calculators include:

- Savings and Investment Strategies: Help you create a plan for saving and investing your money to grow your retirement nest egg.

- Progress Tracking: Track your progress towards your retirement savings goals, making adjustments as needed to stay on course.

- Integration with Various Savings Accounts: Include data from multiple savings and investment accounts, giving you a holistic view of your retirement savings.

- Tax Considerations: Many of these tools do not consider taxes.

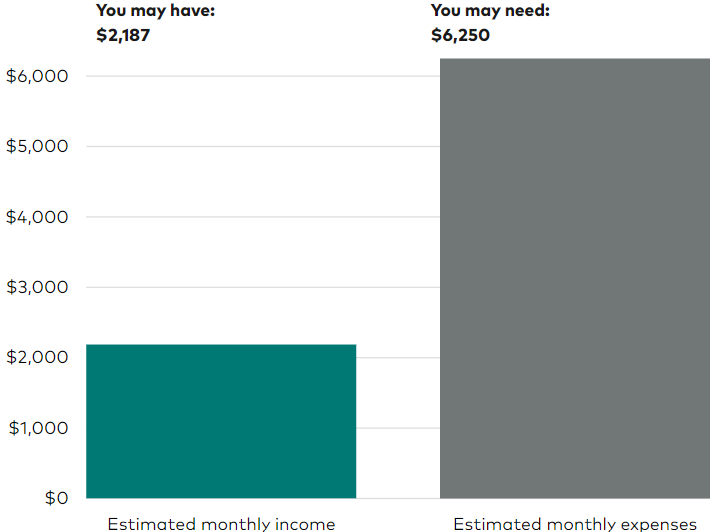

- Graphical Representation of Savings Growth: Basic charts as shown in the example above.

- Retirement Goals: Estimate whether you will meet your retirement savings goals based on your current savings rate and investment returns.

Retirement Income Planning Calculators

Retirement income planning calculators are designed to help you manage your finances during retirement. These calculators focus on creating a predictive plan for how to withdraw from various income sources, considering tax minimization strategies to ensure you get the most out of your savings.

- Retirementize

- Conquest

- NewRetirement

- SnapProjections

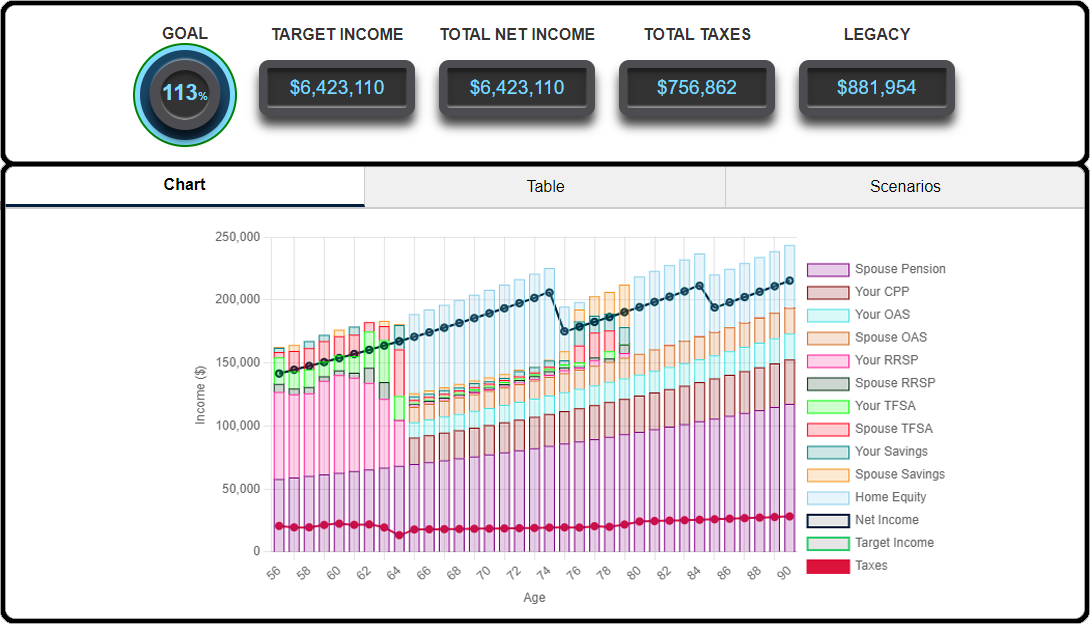

- Predictive Withdrawal Plans: Help you determine the best way to withdraw funds from various income sources (such as pensions, IRAs, RRSPs, and Social Security) to meet your retirement needs.

- Tax Minimization Strategies: Analyzing your income sources and tax brackets. Aim to minimize your tax burden, allowing you to retain more of your retirement savings.

- Integration of Various Income Sources: Combine data from multiple accounts, including pensions, IRAs, RRSPs, TFSAs, Roth IRAs, and savings accounts, providing a comprehensive view of your retirement finances.

- Rental Properties and Primary Residence Assets: Include the value and income potential of your properties, helping you make informed decisions about selling or renting.

- Graphical and Tabular Data Representation: Present your financial plan in both visual and tabular formats, making it easy to understand your retirement strategy.

- Downloadable Data Options: You can export your financial data and plans for further analysis or sharing with financial advisors.

- Multiple Retirement Phases: Consider different stages of retirement (active years, slower years, and late retirement) to tailor your withdrawal strategy accordingly.

Choosing the Right Calculator

The right calculator for you depends on your current stage in the retirement planning process:

- If you are in the accumulation phase, focusing on building your retirement nest egg, a Retirement Savings Accumulation Calculator will provide the strategies and projections you need.

- If you are approaching or already in retirement, then a Retirement Income Planning Calculator will help you manage withdrawals and minimize taxes to maximize your income.

For a more detailed exploration of each type of calculator, check out Retirementize, which offers comprehensive retirement income planning.