Retire at 55 with 500k: Is It Possible?

Are you dreaming of retiring at 55 with 500k in savings? It might seem like a stretch, but with the right planning, budgeting, and tools like our Retirementize income calculator, it’s possible to live a comfortable retirement. Let’s dive into what retiring early with half a million dollars really looks like and how you can make it happen!

First Things First: Assess Your Retirement Expenses

To determine if you can retire at 55 with 500k, you need to get a clear picture of your expected expenses. This includes essentials like housing, food, healthcare, and discretionary spending on travel, hobbies, or even starting a new career (you might be busier in retirement than you think!). A good starting point is creating a solid retirement budget, which you can easily do using a budgeting tool.

How Long Will 500k Last?

One of the biggest questions when planning to retire early is how long your savings will last. The popular 4% rule suggests you can withdraw 4% of your savings each year without running out of money for at least 30 years. With 500k, this gives you an annual income of $20,000. But is that enough? It might be, especially if you consider additional income sources like rental properties or social security, but let’s take a deeper look.

Additional Income Sources: Stretching That 500k

500k may not sound like a lot, but if you plan ahead, you can increase your income streams. Consider these income sources to supplement your retirement savings:

- Rental Properties: Investing in rental properties can provide a steady income stream in retirement.

- Side Gigs: Whether you pick up a part-time job or monetize a hobby, there are many ways to bring in extra income.

- Social Security: While you won’t be eligible for full benefits until 67, you can start collecting social security at 62 to help boost your retirement income.

Health Care: The Elephant in the Room

Health care is one of the biggest unknowns in early retirement. Retiring before you’re eligible for Medicare at 65 means you’ll need to account for private health insurance, which can be costly. According to a 2022 study by Fidelity, the average retired couple will need around $300,000 to cover health care costs alone in retirement. Be sure to factor this into your budget!

Watch Out for Inflation

Retiring at 55 means you’ll need your savings to last at least 30 to 40 years. One thing that can eat away at your purchasing power is inflation. For example, the inflation rate in 2022 soared to over 8%, a sharp reminder of how costs can quickly rise. Make sure your investments are inflation-proof by considering assets like stocks, real estate, or inflation-adjusted bonds.

Living Outside of North America: Exploring Affordable International Options

Retiring abroad is becoming an increasingly popular option for those looking to stretch their retirement savings. Countries like Vietnam and Thailand offer an incredibly affordable cost of living compared to the United States and Canada. For example, in Vietnam, you can live comfortably on around $1,000 to $1,500 per month, which covers rent, food, healthcare, and entertainment. Similarly, Thailand offers expats a high quality of life for roughly $1,200 to $2,000 per month. Both countries boast beautiful landscapes, vibrant cultures, and healthcare systems that are both high-quality and affordable, making them ideal for retirees looking to make their money go further. Plus, these locations offer the chance to experience new adventures while living on a smaller budget. For those considering a move, it’s important to factor in the cost of moving, visa requirements, and the ease of accessing your retirement savings internationally.

An Example that Works

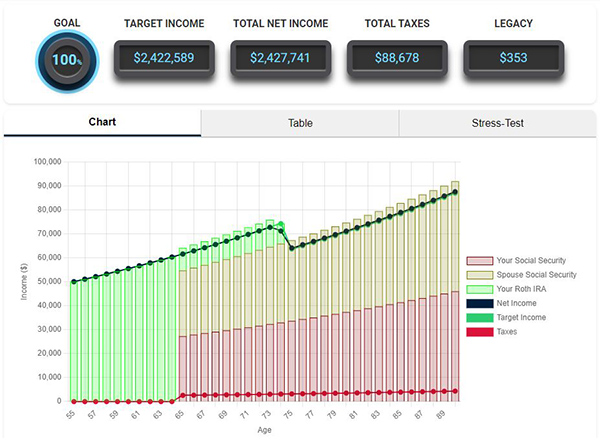

Let's say you and your spouse retire at 55 with $500k. You happily accept an yearly take-home (after-tax) income of $50,000 for the first 20 years of retirement. This is on-par with the average American income. Then at age 75 you recognize that your income needs drop to then American average of $43000/year. This lifestyle is completely doable, with your $500,000 invested in a Roth IRA and an average social security of $1850/month for each person.

Using the Retirementize calculator, you can see the output results of you plan reaching and exceeding your goals!

Fun Facts

- Only 14% of Americans plan to retire before age 60, according to a Gallup poll.

- Most early retirees experience a “honeymoon phase” for the first 1-2 years of retirement.

- Retiring at 55 can give you 20 more years to travel, pursue hobbies, or even start that dream business!

Can You Really Retire at 55 with 500k? It Depends

Retiring at 55 with 500k can be possible if you plan carefully and make strategic decisions. Whether it’s using the Retirementize calculator to optimize your withdrawals, diversifying your income streams with side gigs or rental properties, living outside North America, or keeping an eye on inflation and healthcare costs, there’s a path to a comfortable retirement.

If you’re not sure where to start, check out our other resources like retirement budgeting and the Retirement Income vs. Savings Calculator. And don’t forget to review our articles on common retirement planning mistakes and finding your retirement savings magic number to ensure you’re on the right track.

Conclusion

Retiring at 55 with 500k is achievable if you approach it with realistic expectations, supplement your savings with other income sources, and keep a close eye on inflation and healthcare costs. By utilizing tools like the Retirementize calculator, you can optimize your withdrawals and ensure your golden years are as carefree as possible. So, start planning now, and enjoy the freedom that comes with early retirement!